external network penetration testing

Mergers and acquisitions create periods of extraordinary cybersecurity risk. The acquiring organisation inherits every vulnerability, every undetected compromise, and every compliance gap present in the target’s environment. Without thorough cyber due diligence, these inherited risks remain hidden until they manifest as breaches, regulatory actions, or operational disruptions that the acquirer did not budget for.

Traditional due diligence examines financials, legal obligations, and operational metrics but rarely extends deep enough into cybersecurity posture. A target company might present clean financial statements while harbouring a ransomware incident that has not yet been disclosed, a data breach that has not yet been detected, or compliance violations that carry substantial pending penalties.

Pre-acquisition assessment should examine the target’s security maturity across multiple dimensions. Technology controls, governance frameworks, incident history, compliance status, third-party risk management, and data protection practices all contribute to the overall risk profile. Each dimension can contain issues that materially affect the value proposition of the transaction.

Active compromise detection is essential during due diligence. Performing threat hunting across the target’s environment identifies ongoing breaches that the target’s security team has not detected. Discovering that a threat actor already has persistent access to the target’s network before completion allows the acquirer to account for remediation costs or renegotiate terms accordingly.

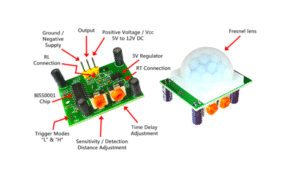

Regular external network penetration testing of the target’s internet-facing infrastructure reveals the vulnerabilities visible to attackers. This assessment provides a concrete picture of the target’s external security posture, identifying exposed services, misconfigured systems, and known vulnerabilities that indicate how well the target maintains its defensive perimeter.

Expert Commentary

William Fieldhouse | Director of Aardwolf Security Ltd

“Cyber due diligence during M&A transactions reveals risks that traditional financial and legal due diligence cannot see. We have assessed acquisition targets and discovered active breaches, unpatched critical infrastructure, and compliance violations that fundamentally altered the deal terms. Discovering these issues after completion means inheriting them without recourse.”

Intellectual property protection assessments determine whether the target’s most valuable digital assets are adequately secured. If the primary value of an acquisition is technology, source code, or data, verifying that these assets are protected from theft, tampering, or unauthorised access is essential to ensuring the acquirer actually receives what they are paying for.

Compliance assessments reveal regulatory exposure that might not appear in legal due diligence. GDPR violations, inadequate data processing agreements, missing security certifications, and non-compliance with industry-specific regulations all carry financial and operational consequences that transfer to the acquirer upon completion.

Integration planning must address security from day one. Connecting the target’s network to the acquirer’s infrastructure without first remediating identified vulnerabilities extends the target’s risk into the acquirer’s environment. Phased integration plans that address security gaps before establishing connectivity protect both organisations during the transition.

Comprehensive vulnerability scanning services across the target’s entire technology estate provide a detailed inventory of security issues that require remediation. These scan results inform integration budgets, timelines, and prioritisation decisions, ensuring that security remediation receives appropriate resources within the broader integration programme.

Cybersecurity due diligence is no longer optional in M&A transactions. The risk of inheriting an active breach, a pending regulatory action, or a fundamentally insecure infrastructure is too high to accept without thorough investigation. Organisations that invest in comprehensive cyber due diligence make better-informed acquisition decisions and avoid the costly surprises that catch less diligent acquirers off guard.